The Buzz on Senior Whole Life Insurance

Table of ContentsThe Greatest Guide To Child Whole Life InsuranceThe 3-Minute Rule for Kentucky Farm BureauNot known Facts About Cancer Life Insurance

A term insurance plan mores than unless you can restore the policy - Life insurance online. If you restore (if the plan has that attribute), it will certainly renew at a higher price showing the present age of the insured person. Term insurance policy has no buildup of cash money value as a few other sorts of insurance policy enable.

It supplies for people who depend upon you, yet usually finishes by the time kids are expanded and independent, often when the policy proprietor is all set to retire. Other kinds of life insurance offer both a death benefit and a money worth. Their costs are greater than term life costs, because they fund the money value account in addition to supplying insurance.

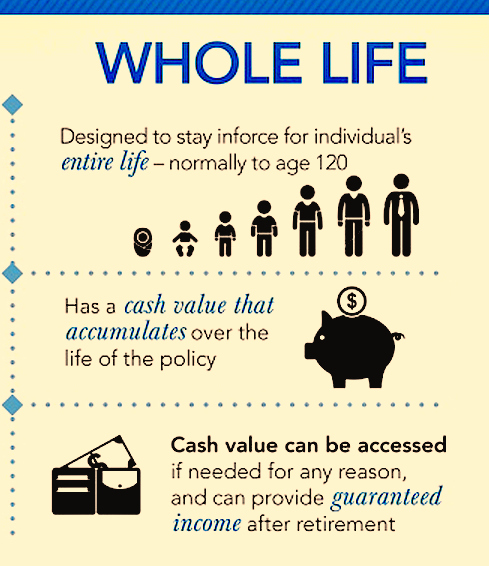

Entire life insurance policy is made to offer defense for dependents while developing cash money worth. In enhancement to paying a death benefit, an entire life policy enables buildup of cash worth that the policy proprietor receives if the plan is given up.

Top Guidelines Of Cancer Life Insurance

Whole life plans set you back more than term insurance coverage, yet have the advantage that the plan constructs cash money worth - Life insurance quote online. Various kinds of life insurance coverage satisfy the requirements for individuals in various phases of life.

Universal life insurance gives the insurance holder a lot more control over costs, provides permanent security for dependents and is more versatile than an entire life policy. It pays a survivor benefit to the called beneficiary, as well as allows the ability to gather cash value. Generally, a global life policy supplies versatility by enabling the plan proprietor to alter the death benefit at specific times, or to vary the quantity or timing of costs settlements.

Another sort of insurance policy, variable life, supplies extra financial investment choices in separate accounts. It additionally needs that the policy owner take some time to handle the investments. Should I purchase Life Insurance coverage for my kids or for my moms and dads? The primary factor to obtain a life insurance coverage policy is to replace income should the guaranteed person die (Life insurance companies near me).

The Definitive Guide to Cancer Life Insurance

For added details on purchasing Life Insurance policy, Medical Insurance or Annuities, please visit the National Association of Insurance Policy Commissioners (NAIC) website.

Life insurance policy can assist protect you and your enjoyed ones monetarily if something unforeseen occurs. What life insurance policy covers Different life insurance coverage items are designed to safeguard you from various events that can occur: If you were a One, Path Life consumer in between 2010 and also 2016 or a Liberty Insurance coverage customer in between 2010 as well as 2018, you more helpful hints might be entitled to a compensation payment.